Senior Housing Outlook 2020-2029

Strong investor returns, portfolio diversification, and rising liquidity continue to dominate the headlines for senior housing when discussing opportunities. On the challenges side, continued growth in inventory and ongoing labor shortages are often referenced.

Challenges

Supply/demand imbalances exist in some—but not all—markets across the United States. Indeed, due to supply outpacing demand in the first quarter, a very wide 13-percentage-point difference was recorded between the occupancy rates for the most occupied (San Jose at 94.4 percent) and the least occupied (Houston at 81.4 percent) senior housing markets, according to the National Investment Center for Seniors Housing & Care (NIC) MAP Data Service. Supply has been a more notable issue in many of the Sun Belt metropolitan markets, and less remarkable in the higher barrier-to-entry markets such as Northern California.

In general, demand for the aggregated NIC MAP 31 markets has been solid—just not solid enough to absorb all the new inventory being built. For example, net absorption reached a record high level in the fourth quarter of 2018, buttressed by a robust economy and positive consumer sentiment. However, inventory growth has been stronger for a longer period. As

a result, the occupancy rate for senior housing stood at 88.1 percent in the first quarter of 2019, a near seven-year low.

The second challenge is the labor market. Commonly and frequently, operators are reporting labor shortages in all occupations across their operating platforms, ranging from care managers to executive directors. With the national unemployment rate at 3.6 percent in May 2019, the challenge of recruiting and retaining employees is significant. Shortages in the health care professions as well as in other industry sectors, such as the construction trades, are putting upward pressure on wage rates. In the first quarter of 2019, average hourly earnings rose 4.6 percent for assisted-living employees on a year-over-year basis, according to the U.S. Bureau of Labor Statistics.

Opportunities

First, private-equity returns for senior housing properties continue to outpace those of other commercial real estate on a 10-, five-, three-, and one-year basis (except for industrial). According to first-quarter 2019 National Council of Real Estate Investment Fiduciaries (NCREIF) Property Index (NPI) results, the total return for senior housing on a 10-year basis

was 11.73 percent—far outpacing the overall property index of 8.51 percent and apartment returns of 8.64 percent. And on a one-year basis, the total return for senior housing was 8.50 percent, beating the NPI (6.83 percent) and the apartment sector (5.90 percent).

Second, with nearly two of every three properties built before 2000, the inventory of senior housing properties is relatively old, and often a property refresh is needed for design, functionality, and efficiency.

Third, senior housing is increasingly recognized as a critical part of the solution for population health management and health care cost containment—a growing social, economic, and political reality. Indeed, operators are increasingly becoming involved with or creating their own managed Medicare organizations.

Fourth, investment in senior housing provides diversification because the sector is not as cyclical as other property types and was shown to be recession-resilient during the global financial crisis (GFC). Its “needs-based” demand characteristics allowed assisted living to withstand many of the downwind recession pressures faced by other commercial real estate

sectors. Fifth, transparency and understanding of the sector continue to grow, which provides a more knowledgeable and disciplined capital market. Information about market fundamentals and capital market conditions is readily available from sources such as the NIC MAP Data Service and Real Capital Analytics (RCA), as well as Wall Street analysts’ reports on health care real estate investment trusts. As a result, banks are paying more attention to market conditions before providing proceeds to borrowers and opportunities are being scrutinized and have been turned down due to market conditions. And lastly, as transaction volumes increase, investors have become more comfortable knowing that multiple exit strategies are likely.

Taken in its entirety, it continues to be a time for a cautious near-term approach in the senior housing sector. At present, some operators in select metropolitan areas face challenging market conditions since supply has outpaced demand. Operators and investors who underwrote deals with 90 percent or 95 percent stabilized occupancy rates a few years ago are facing pressures as they open into markets with 85 percent or lower occupancy rates. In a time of rising expense pressures, where average hourly earnings for assisted living operators are increasing at a 5 percent annual clip, achieving net operating income (NOI) expectations may be difficult.

On the other hand, investors who have partnered with solid operators located in strong markets are seeing outsized investment returns today. And for those who are not yet seeing these returns, they can perhaps draw comfort from the prospects of the demographics coming, although perhaps not immediately. For those investors with capital, holding money on the sidelines may be a good near-term strategy, as a growing number of distressed deals need capital infusion, recapitalizations, and new partners.

Middle-Market Opportunity

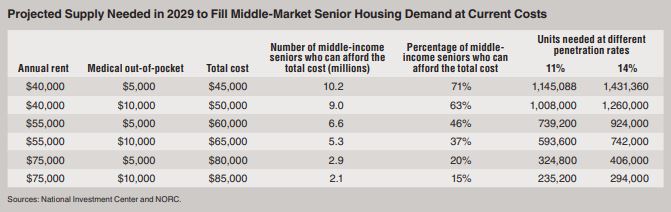

In May 2019, the NIC released the results of its study called The Forgotten Middle. The purpose of the study was to draw attention to a significant pool of unmet demand by a large and growing cohort of seniors. The cohort includes those seniors who have too much in financial resources to qualify for government support programs such as Medicaid, but not enough to pay for most private-pay options for very long. This “middle income” group of seniors is defined as those individuals with annual financial resources ranging from $25,000 to $74,000 for people ages 75 to 84 and $24,000 to $95,000 for those ages 85 and older in the year 2029.

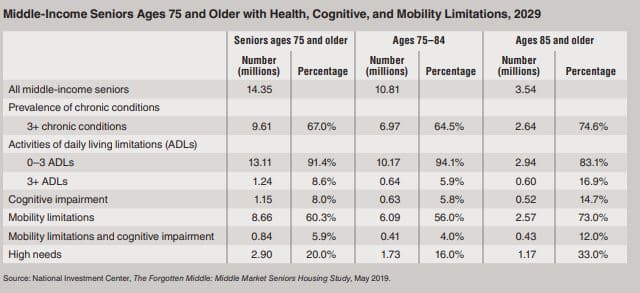

The study found that with the aging of the baby boom generation, the total number of middle-income seniors 75 and older will grow 82 percent from 8 million in 2014 to 14.4 million in 2029. According to the research, middle-income seniors will be more racially and ethnically diverse, with minorities increasing from 9 percent of the population 75 and older today to 16

percent in 2029. Furthermore, more middle-income seniors will be college-educated. Growing levels of education will result in a higher average income for future seniors. In addition, by 2029, the proportion of seniors who are married is expected to decline, with marriage rates expected to fall from 61 percent of people 75 and older in 2014 to 52 percent in 2029. In terms of health conditions, cognitive impairments and mobility limitations will be significant among this group—60 percent of seniors are expected to have mobility limitations, while 8 percent will have cognitive impairments.

Taken as a whole, these conditions and characteristics suggest a need for any seniors to transition out of their homes to assisted-living settings as it becomes increasingly difficult to navigate their traditional residential homes independently. The study estimates that 46 percent of the nation’s middle-income seniors (6.6 million) will have sufficient financial

resources (which includes income and non-housing assets) to pay for projected average annual costs a decade from now of $55,000 for assisted-living rent and $5,000 for out-of-pocket medical costs, when they include the equity of their homes. Still, at an 11 percent penetration rate, an additional 700,000 senior housing units would be needed to be built by 2029 if this new demand is to be satisfied. If the penetration rate were to rise to 14 percent, more than 900,000 units will be needed.

The NIC study was not a solutions study. It did not prescribe specific ways to address the middle-market seniors’ housing needs. Early conversations with stakeholders suggest that innovative financial structures and operating models will be needed to provide care and housing options for America’s cohort of middle-income seniors.

—National Investment Center for Seniors Housing & Care (NIC)

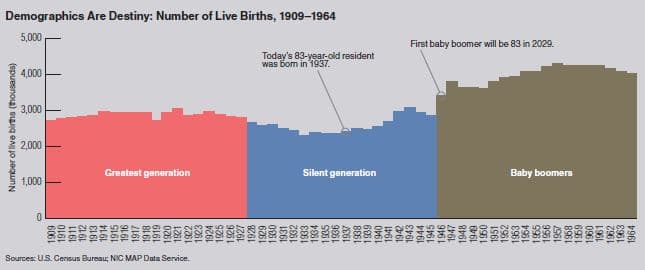

The underlying fundamentals and drivers of senior housing remain in place. First, the demographics alone support the growing need for care and housing for seniors. Today, there are seven adult children aged 45 to 64 to care for every senior over the age of 80. By 2030, this ratio shrinks to 4:1, and, by 2050, it becomes 3:1. The existence of fewer caregivers suggests that community-based congregate settings will be needed more than ever. Furthermore, the long-awaited surge in baby boomers as residents of senior housing is that much closer, with the oldest baby boomer born in 1946 to be age 83 (typical age of a resident to move into senior housing) in 2029. And, for those operators and investors that cater to a younger baby boomer in active adult housing, the opportunity is now. Second, with nearly two of every three properties built before 2000, the inventory of senior housing properties is relatively old, and often a property refresh is needed for design, functionality, and efficiency. And, as obsolescence increases, new supply is needed at least in some markets. Moreover, COVID may have accelerated obsolescence as building design is moving front and center for improved safety and health outcomes. Third, senior housing is increasingly recognized as a critical part of the solution for population health management and health care cost containment—a growing social, economic, and political reality.

Moreover, the need for care and housing is especially acute for middle-income seniors. NIC’s Forgotten Middle study highlighted that point, with only 46 percent of middle-income seniors capable of affording senior housing and care by 2029. It is likely that, as a result of the pandemic and the secondary impact it has had on the economy, more Americans than ever

will slip into the forgotten middle-income cohort, making the need for affordable care and housing ever more pressing.

Finally, the investment thesis for senior housing includes the diversification benefits it offers to a portfolio because the sector continues to have a “needs-based” demand characteristic that will ultimately provide a floor for occupancy rates and will provide a degree of counter cyclicality as compared to other property types. This will be especially important in the coming months as other sectors such as retail and hotels remain challenged. And lastly, as capital flows into the sector rise, transaction volumes and pricing will have support, especially with the knowledge that multiple exit strategies exist.

Taken in its entirety, senior housing investing continues to offer intriguing opportunities but not without challenges. For some, it will be a time for dispositions. For some, a time for consolidation and mergers. For others, it will be time to develop safe, best-in-class buildings that can readily protect residents from germ-laden air particles. And for some investors with capital, holding money on the sidelines may be a good near-term strategy as a growing number of distressed deals need capital infusion, recapitalizations, and new partners.

—National Investment Center for Seniors Housing & Care (NIC)